The Indian Electric Two-Wheeler Industry: Current Status and Future Trajectory

India's electric two-wheeler (E2W) sector has emerged as a pivotal driver of sustainable mobility, reshaping the nation’s transportation landscape. Comprising electric motorcycles, scooters, and bicycles, this industry is fueled by policy incentives, technological advancements, and shifting consumer preferences. Below is an in-depth analysis of its current state and future trends.

1. Current Landscape

Market Growth and Structure

The E2W segment dominates India’s EV market, accounting for over 65% of total EV sales in 2025 . Key drivers include:

- Policy Support: The FAME II scheme, extended until 2027, provides subsidies of up to ₹15,000 per kilowatt-hour (kWh) for electric scooters and Motorcycles, alongside incentives for local manufacturing .

- Cost Efficiency: Electric two-wheelers offer lower operating costs (₹0.10–0.15/km vs. ₹3–4/km for gasoline bikes) and reduced maintenance needs, appealing to price-sensitive consumers .

- Urbanization: With 34% of India’s population residing in cities, E2Ws address urban congestion and air pollution, particularly in megacities like Delhi and Mumbai .

In 2024, sales of electric two-wheelers surged to 1.2 million units, representing a 27% share of the overall two-wheeler market . Leading players include:

- Ola Electric: Dominates with a 30.2% market share (July 2024), driven by its S1 Pro scooter and aggressive pricing .

- TVS Motor: Gained traction with its iQube and Apache RTR Electric, capturing 18.8% share .

- Ather Energy: Known for premium scooters like the 450X, focusing on smart features and fast-charging .

- Chinese Brands: Players like Yadea and Niu have entered via local partnerships, targeting the mid-tier market .

Challenges

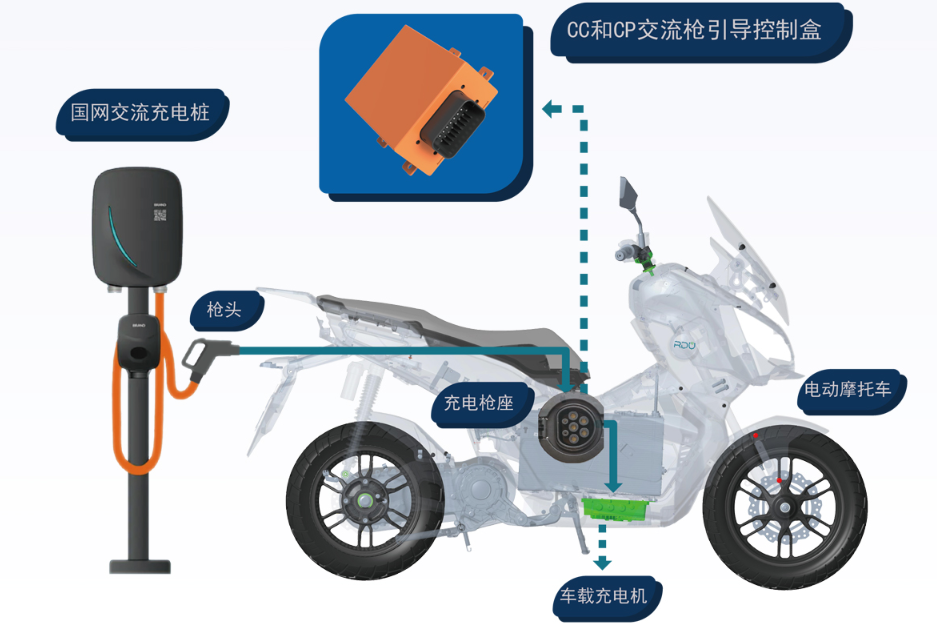

- Infrastructure Gaps: Despite 20,000 public chargers nationwide, coverage remains skewed toward urban centers, with rural areas lagging .

- Battery Costs: Lithium-ion batteries account for 40–50% of E2W prices, though global prices dropped to ₹0.56/Wh in 2024, reducing costs .

- Consumer Trust: Concerns over battery longevity, range anxiety, and charging inconvenience persist, particularly in tier-2 cities .

2. Future Trends

Technological Innovations

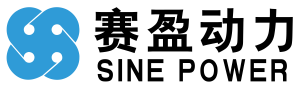

- Battery Advancements:

- Lithium Iron Phosphate (LFP): Gaining traction for its lower cost and higher safety, with companies like Hero Electric adopting LFP batteries .

- Solid-State Batteries: Pilot projects by Ola Electric aim to commercialize solid-state batteries by 2026, promising 50% longer range and faster charging .

- Connectivity and AI:

- Ather Energy’s Ather Grid uses AI to optimize charging networks, while Ola’s Ola Play integrates navigation and battery health monitoring .

Policy and Infrastructure

- FAME III Proposals: The government plans to prioritize battery swapping and grid integration, with a target of 50,000 public chargers by 2027 .

- State Initiatives: Karnataka and Maharashtra are developing smart charging corridors on highways, offering subsidies for private charging stations .

Market Expansion

- Rural Penetration: Electric bicycles and low-cost scooters (e.g., Hero Electric’s Optima) are gaining traction in rural areas, supported by agricultural subsidies .

- Shared Mobility: Companies like Bounce and Vogo are deploying Electric Scooters for ride-sharing, targeting commuters in Bengaluru and Pune .

- Exports: Ola Electric and TVS Motor are eyeing Southeast Asia and Africa, leveraging India’s cost-competitive manufacturing .

Sustainability and Circular Economy

- Battery Recycling: The government’s Battery Swapping Policy mandates 90% recycling of lithium-ion batteries, with startups like Log9 Materials leading in closed-loop systems .

- Renewable Energy Integration: Solar-powered charging stations, such as those by Tata Power, are reducing grid dependency and carbon footprints .

3. Competitive Dynamics

- Price Wars: Ola Electric’s aggressive pricing (e.g., ₹99,999 for S1 Air) has forced rivals like Bajaj Auto and Hero MotoCorp to launch budget models .

- Local vs. Global Players: Indian brands dominate the market, but Chinese firms like BYD and MG are entering via CKD (completely knocked down) assembly, targeting premium segments .

- Startups: Companies like Ather Energy and Simple Energy are disrupting the market with direct-to-consumer models and modular designs .

4. Conclusion

India’s E2W industry is at an inflection point, driven by policy tailwinds, falling battery costs, and urban demand. While challenges like infrastructure gaps and consumer skepticism persist, the sector is poised for exponential growth, with projections of 30–40% market share by 2030 . To sustain momentum, stakeholders must prioritize localized manufacturing, scalable charging networks, and consumer education. With these measures, India could emerge as a global hub for affordable and sustainable electric mobility.

Key Statistics:

- Market Size: ₹6,161 crore (2023) → ₹33,915 crore (2030) (CAGR: 32.7%) .

- Charging Infrastructure: 20,000 public chargers (2025) → 50,000+ by 2027 .

- Battery Cost: ₹0.56/Wh (2024) → ₹0.40/Wh (2027) .

This transformation not only aligns with India’s climate goals but also offers immense opportunities for investors, innovators, and policymakers to shape the future of clean transportation.

Add comment

Add comment: