Surviving Trade Tensions: How Chinese E-Motorcycle and E-Tricycle Manufacturers Can Thrive in Global

I. Survival Challenges and Strategic Directions Amid Trade Conflicts

Escalating Sino-US trade tensions are reshaping the global electric mobility landscape. By 2025, US tariffs on Chinese electric vehicles (EVs) are set to surge to 245%, while the Inflation Reduction Act mandates strict local supply chain requirements, threatening to erase profit margins for direct exporters to the US. Meanwhile, the EU has launched anti-subsidy investigations into Chinese EVs, pushing Southeast Asia to the forefront of global competition. Chinese e-motorcycle and e-tricycle enterprises must break through via market restructuring, technological leapfrogging, and ecological innovation.

II. Market Restructuring: From Single-Dependence to Global Diversification

Southeast Asia: Leveraging Policy Dividends as a Strategic Base

Southeast Asia, driven by policy incentives and a young population, has become China’s "second home market." Indonesia’s "petrol-to-electric" plan aims for 20% e-motorcycle penetration by 2025, offering ₱7 million IDR (≈$460) subsidies per vehicle. Companies in Wuxi Xishan District adopt an "overseas warehouse + local production" model, establishing 14 manufacturing bases in Indonesia and the Philippines, achieving a 68.8% YoY growth in 整车 exports (complete vehicle exports) in 2024. For example, Enwa Technology dominates 70% of the Philippine market with 3 local factories and 350 stores, achieving 60% local supply chain integration.Africa and the Middle East: Cultivating Blue Ocean Markets

Africa’s demand for low-cost transportation is surging, with motorcycle ownership in Nigeria and Egypt growing over 10% annually. Jiangmen Zhenghao Motorcycle uses a "base model," building assembly plants in Mexico and Angola to export technology and equipment, shipping 120,000 vehicles in 2023. The Middle East, driven by green 转型 (green transformation) funded by petrodollars, sees the UAE targeting 30% EV adoption by 2030. Chinese enterprises increased exports to the Middle East by 23% in 2024 through platforms like the Dubai Electric Vehicle Exhibition.Europe and the US: Strategic Compliance for Market Penetration

To navigate US tariffs, companies use third-country transshipment (e.g., reloading in Malaysia with local certificates of origin) to bypass 772.5% anti-dumping duties. A tinplate manufacturer, for instance, successfully entered the US market via Malaysian transit. In Europe, meeting strict environmental standards is key: TAILG’s graphene batteries, certified by CE, offer a 220km range, boosting exports to France by 17% in 2024.

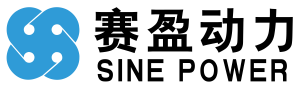

III. Technological Leapfrogging: From Cost Leadership to Value Innovation

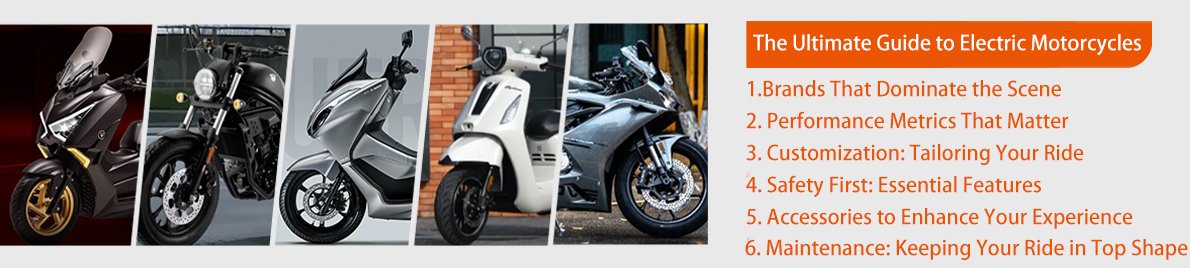

Core Technology Breakthroughs

Chinese firms lead in battery and motor innovations. CATL’s 15GWh battery factory in Indonesia, leveraging local nickel resources, reduces costs by 20%. Duerte Vehicles, with 40 patents, produces dual-drive e-scooters with a 220km range and 130KM/H top speed, capturing over 30% of the French market.Differentiated Product Positioning

Adapting to regional needs: TAILG develops waterproof motors and rust-resistant frames for Southeast Asia’s humid climate; Zhufeng Motorcycle designs 200kg-load e-tricycles for African logistics, controlling 45% of Nigeria’s market. In premium segments, Yadea’s Gova series, equipped with smart connectivity, sells for €5,999 in Europe, redefining China’s low-cost brand image.Standard-Setting Leadership

China has led the formulation of 12 international standards, including electric motorcycle Safety Requirements, adopted by ASEAN. Wuxi Xishan enterprises promote unified European after-sales service centers, enhancing brand trust through standardized maintenance.

IV. Ecological Innovation: From Isolated Advantages to Ecosystem Reconstruction

Localized Supply Chain Integration

With 22% of global nickel reserves, Indonesia enables Chinese firms to build "mining-smelting-battery" vertical ecosystems. Huayou Cobalt completed a 50,000-ton precursor project in Indonesia in just 284 days, reducing costs by 15% compared to domestic production. Zony in Indonesia achieves 60% local supply chain integration, employing 3,000 workers at 20% above local wages.Cross-Border E-Commerce and Digital Marketing

The Yangtze River Delta (Wuxi) EV Cross-Border E-Commerce Industrial Park saw exports grow over 500% via the "9710 model" in 2024, driving $36 million in transactions. Companies use TikTok live streams and Google Ads to reduce customer acquisition costs by 40%. A leading brand’s "30-day free trial" on Amazon US doubled conversion rates compared to industry averages.Policy Coordination and Legal Strategies

China has challenged the US Inflation Reduction Act’s discriminatory subsidies at the WTO, uniting Brazil, India, and others to revise the Agreement on Subsidies and Countervailing Measures. Enterprises can apply for "small business tariff exemptions," such as splitting orders below $5,000 to avoid Section 301 duties.

V. Future Outlook: Redefining Global Competitiveness

Sino-US trade conflicts accelerate global supply chain restructuring. Chinese e-motorcycle and e-tricycle enterprises must seize three trends:

- The Technology-Policy-Market Triangle: Use technological innovation to meet policy standards, leverage policy dividends to expand markets, and create a positive feedback loop.

- Exporting Green Manufacturing Standards: Promote global adoption of Chinese standards through practices like battery recycling and green energy production.

- Ecosystem Alliances: Form joint ventures with local partners in Southeast Asia and Africa to share channels and resources, mitigating political risks.

In this industrial transformation, China’s core competitiveness has evolved from "cost advantage" to "ecosystem integration." Through market diversification, technological autonomy, and localized supply chains, the industry is transitioning from "World Factory" to "Global Ecosystem Leader," delivering Chinese solutions for global green mobility.

This analysis highlights actionable strategies for Chinese manufacturers to not only survive trade tensions but also redefine their role in the global electric mobility revolution. By aligning with regional policies, investing in R&D, and building inclusive ecosystems, they can turn challenges into opportunities for sustainable global growth.

Add comment

Add comment: